Investment

in Arriyadh

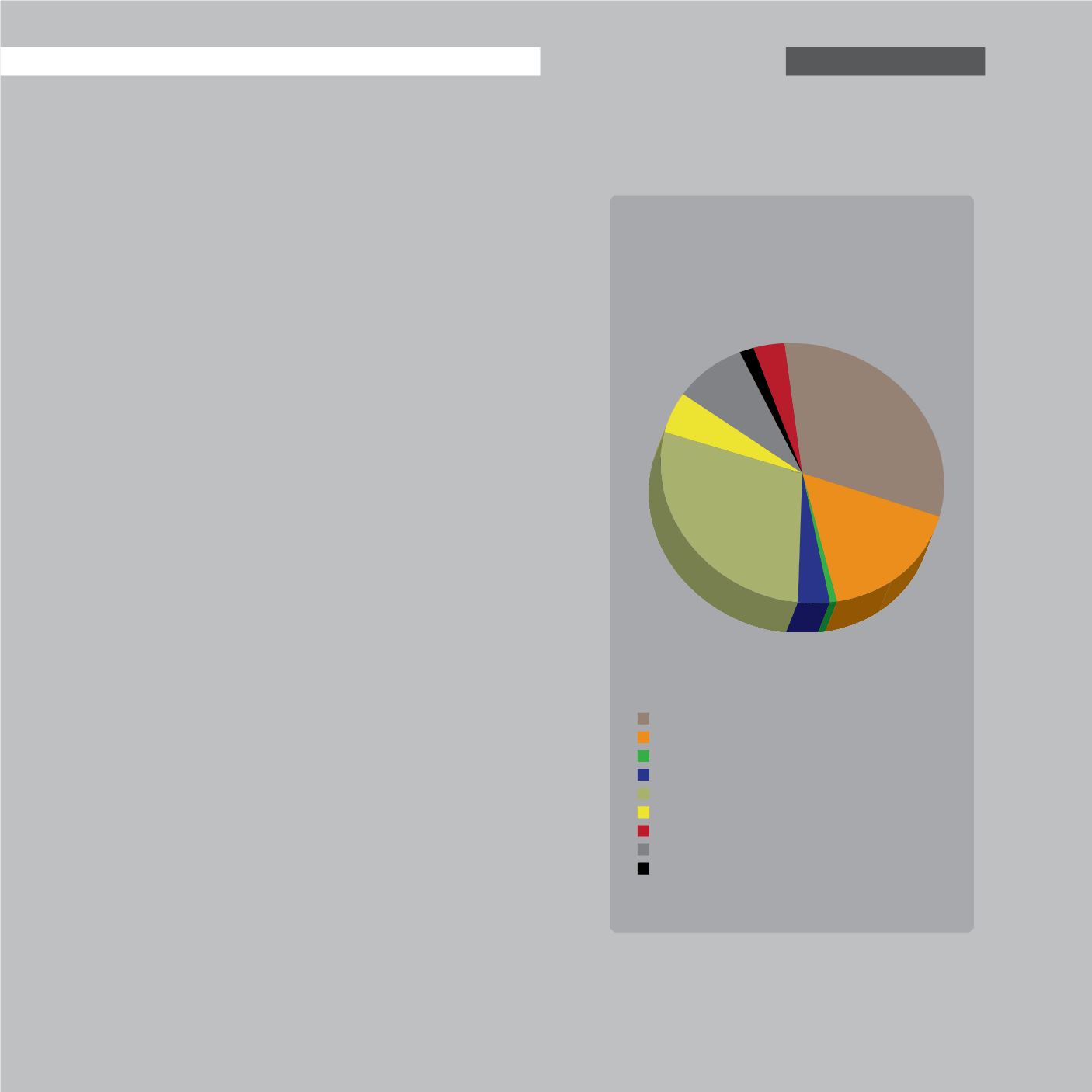

State budget allocations

for the fiscal year 2012/2013

by major sectors (%)

30.8

16.1

4.8 1.6

24.3

3.0

8.8

1.6 5.3

Defence and National Security

Subsidies

Economic Sources Development

General Directorate and General Items

Human Resources

Health and Social Development

Specialised Governmental Loaning Institute

Transport and Telecommunications

Development of Infrastructure Facilites

complemented by major strategic acquisitions abroad, such as those

made by Saudi Aramco and SABIC.

The output of oil and gas accounts for around half of the Kingdom’s

$748 billion economy. Saudi Arabia continues to underpin international

oil price stability by acting as a swing producer. As a result, in the

first quarter of 2014, as political upheavals struck at production in

Libya and Iraq, the GNP contribution from hydrocarbon output grew

5.8 percent, up from 4.1 percent in the previous quarter. This was the

strongest increase since 2012.

There has however long been a recognition that the Kingdom needs

to build a parallel non-oil economy. Since joining the World Trade

Organization (WTO) in 2005, Saudi business has worked hard to face

the full force of overseas competitors in key fields such as construction,

engineering and transportation. While Saudi companies have hired

world-class talent and acquired state-of-the-art technology to build

their own capacities, there have been and remain key opportunities for

foreign investors to take a stake in local firms or indeed, if they wish,

establish, stand-alone businesses.

A report ‘How companies in emerging markets are winning at

home’ issued in the summer of 2014 by the highly respected Boston

Consulting Group details the dominant position of two Saudi firms.

One is the world’s largest distributor of Toyota vehicles, while the

other, Arriyadh-based Almarai, which was born of a joint-venture

with an Irish business, is now the largest integrated dairy company in

the world, with 2013 revenues of $3 billion. Private investors are also

deeply involved in major projects. Thus, for instance, the Saudi Arabian

Mining Company (Ma’aden) is in the process of building a $9 billion

phosphate mine at Al Jalamid, which includes, extensive processing

and a range of other downstream factories, to say nothing of a railway

linking it with the Arabian Gulf coast, a power station, water plant and

a small town to sustain its managers and workers.

Arriyadh-based Ma’aden is the Kingdom’s largest mining company.

Established as a state enterprise in 1997, half its shares are now

publicly-owned and quoted on the Saudi Stock Exchange (Tadawul).

It is estimated that Al Jalamid deposits contain 534 million tons of

phosphates. These will be transported for export or local markets on a

1,400-kilometer freight link to the coast, currently being built by Saudi

Railways.

15